Home » Cambodia Publication » Cambodia Poised to Clarify Profit Attribution and Transfer Pricing of Cross Border Shipping Income

Cambodia Poised to Clarify Profit Attribution and Transfer Pricing of Cross Border Shipping Income

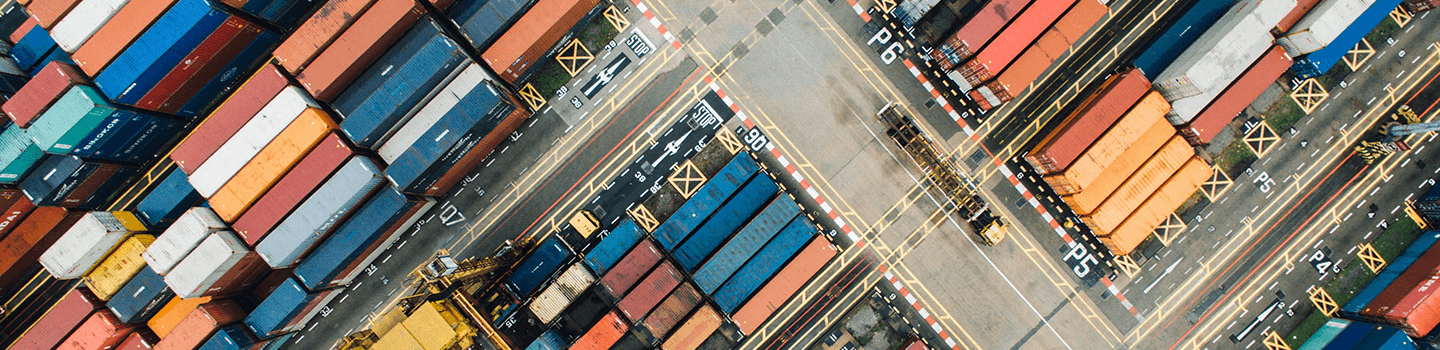

April 29, 2024The determination and taxation of the Cambodian sourced income of international shipping liners has long posed problems in this dynamic Southeast Asian country. As a longstanding manufacturing hub, imports of raw materials and export of finished and semi-finished products are hallmarks of Cambodia’s robust economy. However, the taxation of shipping lines has been an area of uncertainty and concern for many years. This was not alleviated when Cambodia introduced transfer pricing (“TP”) in 2017 by means of Prakas 986.

Related Articles

- New Tax Audit SOPs in Cambodia: What Businesses Need to Know

- July 31, 2024 - Keynotes from GDT Seminar on SOP and Tax Crime Investigation Workshop

- July 29, 2024 - 看板税に関するカンボジア税務の最新情報

- July 1, 2024 - Cambodia Tax Update: Key Changes to Signboard, Rental, Accommodation, and Public Lighting Taxes

- June 28, 2024 - 30 Days Left for Penalty-free Self-correction of Tax Returns

- May 29, 2024