First Ever Transfer of Shares From a Myanmar Company to a Foreigner: Key Observations From VDB Loi Briefing

April 3, 2017Myanmar’s Directorate of Investment and Company Administration (“DICA”) has for the first time implemented a transfer of shares in a company wholly owned by Myanmar citizens and registered as a Myanmar company to a foreigner. This is a promising news for a wide-range of business owners and foreign investors in Myanmar, given that attracting a foreign investor was extremely challenging in many situations as shares from Myanmar companies could not be transferred to foreigners.

On March 7 2017, VDB Loi organized an exclusive client briefing session in Yangon on this development. In this client briefing note, we explain some of the key observations from our client briefing session and analyze what exactly has changed after the first ever transfer of shares.

What was the earlier situation?

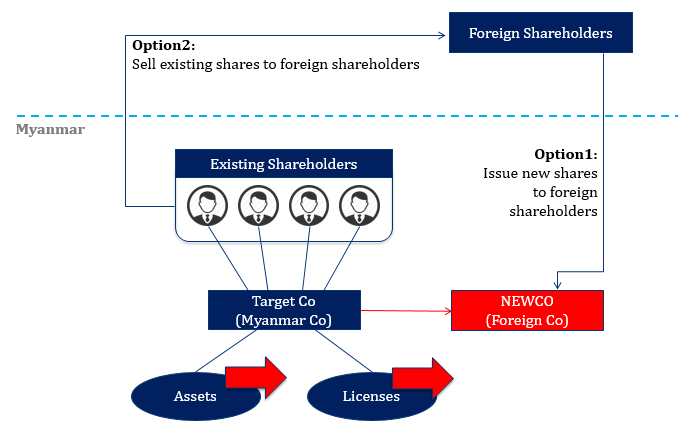

Until DICA implemented the first transfer of shares, conversions from a Myanmar company to foreign company required the establishment of a separate legal entity. In other words, this required the establishment of a joint venture created in Myanmar (by setting up a new foreign company) since the 1987 Foreign Investment Law.

Although a new Foreign Investment Law was passed on 2 November 2012 in Myanmar, rules and restrictions pertaining to conversion from a Myanmar company to a foreign company remained the same. It was administratively impossible for foreigners to acquire shares in a Myanmar company – one that was established and owned exclusively by Myanmar citizens – except through the creation of a new legal entity which was incorporated as a foreign company. Not only was this process time-consuming due to transfer of licenses, assets and employees etc. from the old company to the new, it was also expensive and filled with uncertainties, with all the tax consequences and formalities. Moreover, Myanmar Companies were unable to access funding such as venture capital or private equity in a straightforward manner.

What has changed?

Taking into account the numerous challenges it posed to both local businesses and foreign investors in Myanmar, VDB Loi initiated the solution to this issue with DICA, suggesting how to make the process suitable and working with the authorities to implement this remedy.

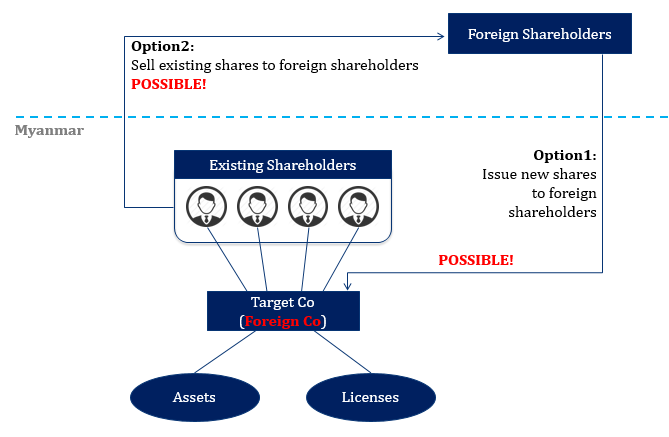

The most important development is that, foreigners in Myanmar can now acquire shares in wholly Myanmar-owned companies, subject to case by case approval and conditions which apply to this “conversion with continuing legal personality”. In other words, investors no longer need resort to beneficial ownership or other solutions using intermediaries or agents.

As for Myanmar companies, this development makes it easier for them to attract foreign investors as they no longer have to set up a new legal entity or experience uncertainties and administrative challenges – such as the need to renew and obtain licenses or assign assets and liabilities – that previously made it impossible for foreigners to acquire shares in a company established and owned exclusively by Myanmar citizens. After conversion, however, a Myanmar company must end activities which foreign companies are not allowed to carry out in Myanmar, such as ownership of immovable properties, most forms of trading and in sectors where foreign investment is not allowed such as banking, insurance and certain types of broadcasting. In addition, the process does not make foreigners in a Myanmar Company. Instead, it allows the Myanmar company to continue its legal existence as a foreign company, with at least some foreign shareholders.

How to do this?

Transferring shares from a Myanmar company to a foreigner is a much simpler process compared to the creation of a new corporate entity, which was incorporated as a foreign company. The process begins with drafting of key documents, which include Board of Director’s resolution and shareholders resolution for transfer of shares.

Step-2 involves submission of documents to the authorities, such as submission of share transfer form to DICA within 21 days from date of creation. Once documents have been submitted, companies must begin the registration of a foreign company, which would include various documents needed for a share issue, a share transfer, application to incorporate a foreign company and an MOA change etc.

KEYWORDS

RELATED EXPERIENCES

Related Articles

- Myanmar Implements the RCEP Reduced Tariff for Nine Members

- May 23, 2025 - DICA Demands Full Compliance Documents for Changes in Directors and Shares

- January 10, 2025 - Consumer Protection in Digital Services: E-Commerce and Digital Payment Systems in Myanmar

- July 9, 2024 - Notice on Documents to be Submitted for the Barter System

- June 27, 2024 - Enforcement of Import License Requirement Begins 1 July 2024

- June 25, 2024